In case you haven’t heard, the tariffs levied against China are now 145%. Yes, you read that right.

Not the 125% you may have heard about yesterday because the math apparently left out an additional 20% increase. Oops!

They’re now well above the prior 104% tariff rate, and the 84% originally in place.

When you start to look at the sequence of events, it becomes clear that it is all just absurd.

What’s next? 200% tariffs? And to what end? What is the goal here and how does this actually get us lower mortgage rates?!

Trump Said He Was Bringing Back 3% Mortgage Rates

During his campaigning in September, now-President Trump said he was going to bring back the ultra-low mortgage rates we came to know and love.

Specifically, he said “Reducing mortgage rates is a big factor.” We’re going to get them back down to, we think, 3%, maybe even lower than that.”

It wasn’t clear how, but once he selected Scott Bessent as Treasury Secretary, the strategy was to lower the 10-year bond yield.

If you didn’t know, the 10-year yield correlates really well with 30-year mortgage rates because they both have a decade-long shelf life.

Most homeowners only keep their home loans for about 10 years because they sell, refinance, prepay, etc.

Anyway, if you’re able to get 10-year yields down, you can get mortgage rates down too.

This appeared to be working in the early months of 2025, but hit a snag in the past week when Liberation Day tariffs got underway.

The 10-Year Yield Surged Yesterday as Bond Selloff Took Place

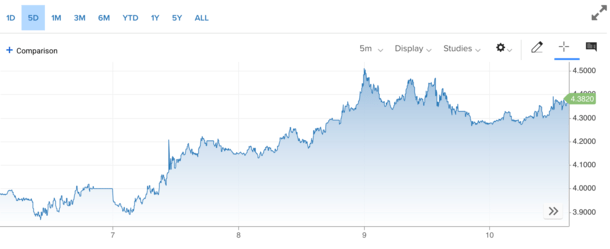

Yesterday, the 10-year yield went haywire as the clock struck midnight on the East Coast.

There was a massive bond selloff and yields climbed above 4.50% from sub-4% just days earlier.

All the ground we had made up in past months was instantly erased, leading to a huge spike in mortgage rates.

The 30-year fixed, which was around 6.5% or lower, climbed back above 7%, terribly inopportune timing with the spring home buying season now underway.

It also undermined rate and term refinancing, which was showing signs of life again in March as rates finally eased and recent buyers were able to snag payment savings.

Now we’re back in familiar territory, with prospective home buyers seeing rates that start with a “7” again.

Problem is for-sale inventory has also increased and home prices were already under pressure in many markets, as was affordability.

This might mean even more inventory sitting around, including all those new listings that hit the market in the past month as housing market conditions appeared to turn favorable.

Now it’s scary to be a seller or a buyer, with the former probably thinking twice about listing, and the latter unsure if they can afford or it. Or if they’ll have a job in a year.

Long story short, this level of uncertainty is bad for mortgage rates, home buyers, and home sellers. And needs to be fixed soon before we risk bigger problems.

Goldilocks Tariffs Might Be Just Right

So how do we actually get lower mortgage rates without blowing up the economy?

Well, first of all we need some clarity on the situation. We can’t keep raising tariffs to infinity.

Nor can we keep kicking the can down the road and delaying tariffs, then reinstating them, then rinsing and repeating.

Aside from alienating our trade partners, we won’t be taken seriously anymore. And folks won’t be able to make major decisions, such as buying a house.

If the administration truly believes in the tariffs, figure out a middle ground. I noted when this first got started that tariffs were bad for mortgage rates.

They can increase the cost of goods, including home building supplies, which leads to inflation and higher interest rates.

But that was when there was a blanket tariff on even our closest of allies, including Canada and Mexico.

It’s possible to target some specific tariffs on some trade partners without causing an outright trade war that accomplishes little more than exacerbating friends.

Finding a middle ground allows us to get back to the economic data at hand, like jobs, CPI, inflation, and other key drivers of mortgage rates.

Showing a sense of stability also means foreign countries will continue to invest in our bonds, thereby increasing their price and bringing yields (interest rates down).

There comes a point where you take it too far and it backfires, as we saw when 10-year bond yields spiked above 4.50% yesterday.

They’ve since calmed down, but remain above 4.35%, meaning the 30-year fixed is still priced around 7%, or perhaps just under.

We Need to Get the Trade War Behind Us

If we can reach some deals here and get the trade war behind us, the economy will matter again to mortgage rates.

And if the data show inflation is continuing to moderate, yields and mortgage rates can come down, as they were in September and October.

I pondered a couple weeks ago what mortgage rates would be like had Kamala Harris won.

There likely wouldn’t have been a trade war or the threat of new tariffs, so only the economic data would matter.

And lately it’s been pretty good for mortgage rates.

They don’t need to (and probably won’t) fall back to 3% anytime soon. A rate somewhere in the low-6s or high-5s seems sufficient these days for most.

It will allow recent home buyers who got stuck with 7%+ mortgage rates to apply for a rate and term refinance.

At the same time, it will give prospective home buyers the green light to move forward with a purchase, thanks to a reasonable rate and more peace of mind knowing there’s some stability in the economy.

Simply put, until there’s greater certainty, expect continued upward pressure on mortgage rates.